How to Craft Safe Notes While Protecting Your Company

South Florida has a thriving, dynamic business environment conducive and inspirational for startups. Statistics indicate that in 2022, the city of Miami alone had an impressive 248 new ventures for every 100,000 people. If you’re exploring a viable business idea with the potential for success and rapid growth, 2022 is the right time to take the plunge. When you start searching around for investors and funding, the term “safe note” will likely come up. Let’s take a quick look at what is a safe note and how it influences the support you can expect.

South Florida has a thriving, dynamic business environment conducive and inspirational for startups. Statistics indicate that in 2022, the city of Miami alone had an impressive 248 new ventures for every 100,000 people. If you’re exploring a viable business idea with the potential for success and rapid growth, 2022 is the right time to take the plunge. When you start searching around for investors and funding, the term “safe note” will likely come up. Let’s take a quick look at what is a safe note and how it influences the support you can expect.

Understanding Safe Notes and How They Work

When startups acquire funding from investors, they may enter into an agreement called the “safe note.” This document is a legally binding contract between the investor and founder that specifies the investor will be offered the opportunity to get equity in the company at a future date.

New companies in the seed stage typically don’t have Key Performance Indicators (KPIs), profits, revenues, or sales that can assure investors that their money is safe. Entrepreneurs must offer other forms of assurance that the investment is safe and likely to provide investors rich returns when they are ready to exit. The safe note is a kind of convertible security and acts as robust collateral for the funding financiers offer.

Unlike Safe Notes, Convertible Notes Can Have Negative Consequences

At the startup’s seed stage, founders are open to offering the equity to investors for the money they need to get the business off the ground. However, honoring the agreement can become challenging once the company is established and growing well. That’s because the convertible note is a kind of debt. Investors can convert the note into equity and walk away with a sizeable portion of the company.

When you’re ready to initiate further fundraising down the road, potential investors might view it as a debt burden and be unwilling to offer finance. Or, new financiers may consider the debt as company ownership that is likely to be passed to the seed investors. These factors may affect the money you can raise in Series A, B, and C rounds. This is why, you’ll enter into a safe note contract instead.

How to Craft the Safe Note While Avoiding Pitfalls

With guidance from an expert consultant or M&A advisor, you can draft a safe note to reassure investors. At the same time, you’ll safeguard your company from unexpected dilution when investors claim their equity. Here’s how:

- Word the safe note in simple, easy-to-understand terms without complex legal jargon that needs a lawyer to understand.

- Safe notes don’t require entrepreneurs to pay interest on the business loans they take.

- You don’t need to offer any information to the investors, board seats, pro-rata rights, or any other conditions that might affect your control of the company.

- You won’t include an end date for the safe note.

- Funding acquired through a safe note is clearly noted in the company’s capitalization records.

- Although investors can convert their investment into equity, there is no fixed timeline for that to happen. Participants of the safe note can work out the details when future funding rounds are initiated.

- You’ll include clauses that provide you with complete control over how the equity-based payouts are made. Ensure that you have the flexibility and room for negotiating how the equity is given.

- Reassure investors by offering the option of getting preferred stock or more substantial returns compared to the possible returns in a convertible note.

Safe notes are an excellent alternative to convertible notes since they ensure that founders retain control of their startups while assuring investors of equity down the line in lieu of their money.

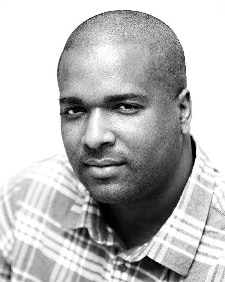

BIO

Alejandro Cremades is a serial entrepreneur and the author of The Art of Startup Fundraising. With a foreword by ‘Shark Tank‘ star, Barbara Corcoran and published by John Wiley & Sons, the book was named one of the best books for entrepreneurs. The book offers a step-by-step guide to today‘s way of raising money for entrepreneurs.

Most recently, Alejandro built and exited CoFoundersLab, which is one of the largest communities of founders online.

Prior to CoFoundersLab, Alejandro worked as a lawyer at King & Spalding, where he was involved in one of the biggest investment arbitration cases in history ($113 billion at stake).

Alejandro is an active speaker and has given guest lectures at the Wharton School of Business, Columbia Business School, and NYU Stern School of Business.

Alejandro has been involved with the JOBS Act since its inception and was invited to the White House and the US House of Representatives to provide his stands on the new regulatory changes concerning fundraising online.