How to manage portfolio risks to avoid big losses?

Managing portfolio risks is perhaps one of the most important skills that experienced traders have and it is what differentiates successful traders from unsuccessful ones.

While most people focus on portfolio returns, seasoned investors and traders understand the importance of risk management to mitigate losses by using simple tools available to most retail traders nowadays.

The following article aims to provide a closer look at these risk management strategies to help you in preventing losses while you navigate today’s volatile markets.

Tool #1 – Stop-loss orders

Stop-loss orders are the most basic tool that traders should understand to mitigate their portfolio risks by limiting the losses they are willing to experience if their trades turn against them.

A stop-loss order basically works by triggering a market order once a stop price is reached. The stop price can be set based on a certain maximum percentage of losses that the trader is willing to take or based on support (or resistance for short positions) identified through technical analysis.

One thing to keep in mind with stop-loss orders is that it is often advisable to keep give the price enough room to fluctuate freely, which means that stop prices shouldn’t be too tight unless the situation calls for it.

Tool #2 – Reward / risk ratio

The reward/risk ratio indicates how many dollars a trader should gain if his target for the trade is accomplished in relation to every dollar he can lose as a result of an unfavorable trade.

Most experienced traders understand the importance of only entering trades that offer both a big upside and a limited downside.

The upside is measured by determining an exit price for the trade while the downside is often understood as maximum loss realized if the stop-loss order is executed.

Tool #3 – Support and Resistances

Support and resistance levels are technical indicators that show price points at which the market has previously struggled to move higher (resistance) or lower (support).

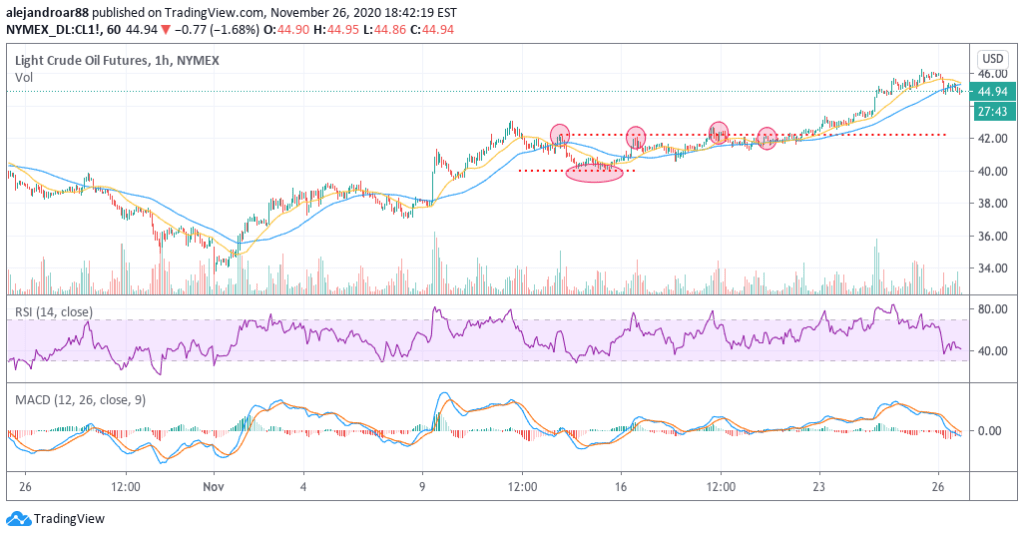

The hourly chart above shows how the price of WTI futures struggled to move above a $42.20 resistance from November 12 to November 20, until they finally broke above this level and ended up surging to $46 a few days after.

Meanwhile, the same chart also shows that the price action found support at the $40 level twice during that same period, which means that buyers showed up to buy WTI futures at that particular price.

Using support and resistances as a risk management strategy makes sense as you can determine your stop price after identifying the closest support level (for long positions) or the closest resistance level (for short positions).

Tool #4 – Maximum size per trade

Experienced traders commonly advised that you should not expose more than 2% to 5% of your portfolio to losses from a single trade.

This means that if you have a portfolio of $5,000, the maximum loss per trade you should be willing to take would go from $100 to $250 per trade.

By limiting the amount of money you can lose per trade while letting your winners run 3 to 4 times higher than your maximum losses you can increase the odds of yielding positive returns.

Tool #5 – Non-correlated trades

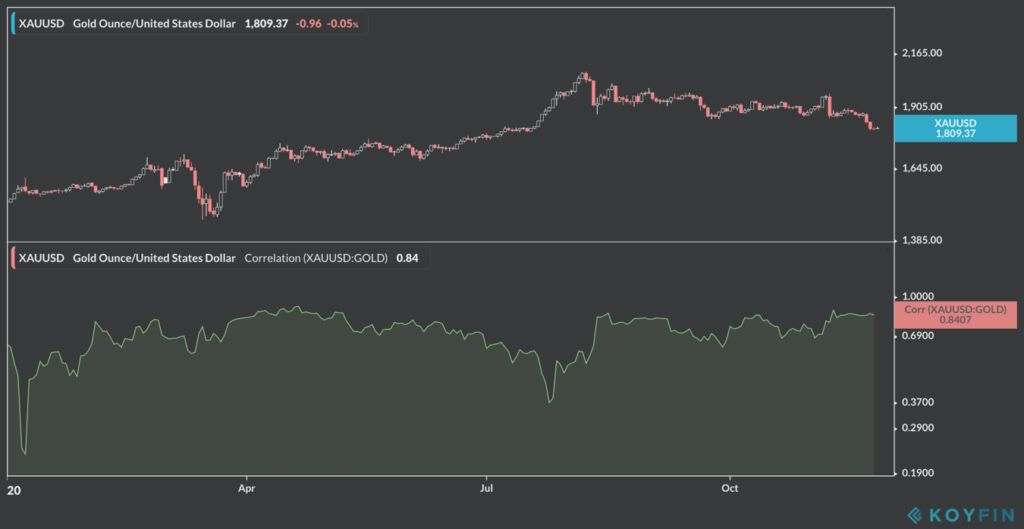

Correlation is a statistical measure of how a variable behaves compared to another. This concept can be applied to financial assets as you can analyze how the performance of one security relates to another one.

Take for example the price of gold and the price of Barrick Gold Corporation (GOLD). The chart above indicates that the correlation between the two securities has been moving above the 0.8 level almost the entire year – a strong correlation – meaning that when gold goes up, Barrick goes up as well, while the stock also tanks when gold goes down.

From the perspective of portfolio management, it doesn’t make much sense to trade both securities as they will perform very similarly.

By analyzing the correlation between your different trades you can cut those that are too heavily correlated to make sure that your portfolio doesn’t decline in the same proportion at the same time.

Bottom Line

Risk management is a skill that all traders should develop to increase their odds of success over time.

By mitigating your losses while also letting your winners run you will be able to make the most out of your trading journey.