How Can You Show Proof Of Income As A Freelancer?

If you want to lease a vehicle or get an apartment, you need to prove that you can make your payments. Here’s how to show proof of income as a freelancer.

Freelance work is growing in popularity. More than 10 million Americans are expected to be self-employed by 2026.

Although many workers are choosing to be self-employed because of the freedom and flexibility it provides, they could have a hard time proving income to get loans for a house or car.

Keep reading below if you’re a freelancer who needs help showing proof of income.

What to Expect When Showing Proof of Income

Although freelance work is growing in popularity, it does pose challenges. It can be difficult to prove your income when you need a loan.

Here are some things to expect when trying to proving your income:

- Be prepared to go into great detail on your work history and how your industry operates

- Reach out to former supervisors or colleagues for endorsements

- Avoid taking too many tax write-offs when you’re applying for a loan

- Hold off filing for an LLC until you apply for a loan

- Prepare a profit-loss statement for yourself or business

The biggest thing to consider when applying for a loan is not to make any significant changes. Banks like to see consistency.

Collect Your Tax Returns to Show Income

Tax returns are a great way to show income. You have to file them every year and they include everything you earned.

When it’s time to file your taxes make sure you don’t forget any “off the books” income. Failing to do so could misrepresent your earnings and put your loan at risk.

Generate Your Own Personal Pay Stubs

Another option for proving income at the end of the year is using a paystub maker. Online companies like PayStubs.net provide affordable, easy-to-use, and secure software programs to produce self-employment pay stubs.

These documents can include your total earnings, as well as any taxes paid and deductions. Stubs can be printed or sent over email as a PDF.

Many of these programs were designed by professional accountants. They want to help you be as precise as possible.

Track Income With Your Bank Account or PayPal

Bank accounts are one of the easiest ways to verify income. Chances are you deposit all of your money into the bank each week and it’s not difficult to access these records.

The key here is making sure you have both a personal and business bank account. They will want to see your business account statements and any related financial documents.

In some cases, you may need to provide certified bank statements. They may also ask for a profit-loss statement.

Many freelancers also use PayPal deposits as proof of income. You can generate separate earnings reports for each of your clients and sign up for additional accounting assistance.

Be Prepared When Applying for a Loan

Freelance work is a viable option and you can live comfortably doing it. But, if you’re trying to show self-employed proof of income for a mortgage or new car, follow the tips we shared above.

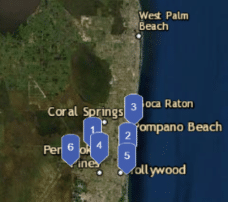

Browse the rest of our website to stay on top of the latest South Florida Caribbean News. Topics include news, business, travel, entertainment, health, and more.