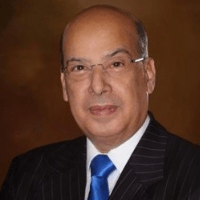

Sir Ronald Sanders Address to Opening of Caribbean Legislative Week

WASHINGTON, DC – Sir Ronald Sanders, Ambassador of Antigua and Barbuda to the US and the OAS on behalf of the Caribbean region addressed the Opening of the Legislative Forum in the US House of Representatives on Wednesday June 5th 2019 during Caribbean Legislative Week on Capitol Hill.

Long before Mexico became the second border of the original 13 states of the United States of America, the countries of the Caribbean were already its border.

Freedom, unfair taxation and the right to trade that underscored the sovereignty of those 13 former British colonies in America were closely tied to their relationship with the Caribbean.

When England sought to punish the newly formed revolutionary United States by banning trade with it, West Indian Islands resisted it, and defied the law to continue it.

One energetic young English naval captain was a casualty of his attempt to enforce the Navigation Act.

His name was Horatio Nelson.

Today his statue towers over Trafalgar Square in London, a hero of the Battle of Waterloo.

But, in 1783, he had not yet learned to turn a blind eye.

He enraged West Indian merchants by enforcing the punitive navigation laws against American trade.

The merchants ganged up against him and threatened him with arrest for detaining five American ships.

They had him removed from his post and he spent 6 years in the wilderness before being recalled to service and winning the battle of Waterloo for which he is now glorified.

I mention this anecdote to underscore how long the Caribbean – and the West Indies particularly – has been an important border to the United States.

The relationship does not end there.

Today, while the United States suffers a trade deficit with many countries and regions of the world, it enjoys a trade surplus with the 14 independent countries of the Caribbean Community collectively.

That trade surplus is perennial.

The surplus has increased every year.

In 2015, it was $4.1 billion; in 2016, it rose to $4.6 billion, jumping to $5.5 billion in 2017, and escalating further to $7 billion in 2018.

In the scale of US global trade, the surplus of $7 billion with CARICOM countries might not amount to much.

But, it is a lot to CARICOM countries.

And, it has provided profits for American companies and jobs for American people.

CARICOM countries have remained loyal and faithful to the US market, buying annually from the United States more than 60 per cent of all that they import.

Throughout the decades of changing international circumstances, CARICOM countries have not sought to diversify their trade away from the US.

That bond that was established between the West Indies and America as the original 13 states fought for their independence and then struggled to maintain it in the face of punitive trade sanctions by the British, has never been weakened or abandoned on the Caribbean side.

Incidentally, it is worth noting that CARICOM countries maintained the trade relationship which so benefits the United States, even as US official development assistance to the region declined.

In 2017, a year in which the US enjoyed a $5.5 billion trade surplus with CARICOM countries, it provided $429 million to all CARICOM countries.

Of the $429 million, Haiti received the lion’s share of $377 million, leaving only $52 million to be divided between the remaining 13 countries.

In that same year, the US total disbursement of assistance worldwide was $47 billion.

As a percentage of that global disbursement, CARICOM countries, including Haiti, received 0.9 percent.

Without Haiti, the percentage declines to 0.1 percent.

Another significant statistic is that of the total amount of US assistance to CARICOM countries, excluding Haiti, 45 per cent of it came from the US Department of Defense and was mostly for the interdiction of drugs flowing from producer countries in South America to user markets in the United States.

I mention these figures, not in complaint; for every country in the world has the right to decide to whom it provides assistance; to what extent it does so; and for what purposes.

I mention them only to observe that since the CARICOM region provides the US with an escalating trade surplus every year, the US should have an interest in the economic growth and prosperity of these nations.

For, if they are unable to maintain a stable rate of economic growth or if they decline, they will no longer be able to purchase goods and services from the US, and the trade surplus which the US has continuously enjoyed will shrink and with its shrinkage will go the revenues and jobs that it generates in America.

Therefore, there is a symbiotic and mutual interest in the US-Caribbean relationship that has to be recalibrated to ensure that, as the ‘third border’ of the US, the Caribbean remains a zone of peace and a stable economic and political space.

Trade between the US and the Caribbean now faces an obstacle.

I draw attention to it here, as I did recently in testimony that I gave to the US international Trade Commission on the Caribbean Basin Economic Recovery Act (CBERA) and the related US legislation, the Caribbean Basin Trade Partnership Act (CBTPA).

Under the CBTPA, the U.S. grants non-reciprocal trade preferences to eight of 17 CBERA recipient countries.

However, this is only possible because of a waiver from the World Trade Organization (WTO).

That waiver expires on 31st December 2019 – this year.

The CBTPA itself expires on 30 September 2020 and it cannot be extended without the WTO waiver.

As a former Ambassador to the World Trade Organization and more than a little experience of negotiations in that body, I am keenly aware that, with 6 months before the expiry of the waiver, if the U.S. government and Congress wish to extend the CBTPA, work on that process should begin with urgency.

I have already pointed out that, despite market access to the U.S. under the CBTPA, CARICOM countries suffer a perennial balance of trade deficit with the US.

Only 8 of the 17 CBERA countries actually get CBTPA treatment.

Those 8 countries would face serious financial challenges if they were to lose the preferential access from which they now gain.

The resultant weakening of the economies of these countries would have a harmful effect on the region by spill-over effects into neighboring states, including the U.S.

Worsening economic and financial conditions in CBTPA and CBERA countries would have, inter alia, the following effects:

- A lack of capacity to purchase goods and services from the U.S. that now benefits U.S. employment and earnings by U.S. companies

- Social and political instability in the Hemisphere which could cause an increase in migrants and refugees into the U.S.

- Decreasing capacity to cope with drug trafficking and organized crime which would have an impact on both Caribbean and U.S security.

In this connection, it is in the interest of the U.S. and the Caribbean for the CBTPA benefits to be continued for existing beneficiaries and extended to others.

And, I call on this conference, to raise its voice in urging that this matter be addressed urgently by the appropriate bodies in the US Congress and in the government of the United States.

The time for talking on this has passed; the time for action is now.

Chair, I turn to a matter euphemistically called “de-risking”.

It has led to the withdrawal of correspondent banking relations from banks in the Caribbean by global banks in the United States.

Yet, correspondent banking relations (or CBR’s) are the life blood of global commerce and human development.

CBR’s are as vital to the world as are air and sea transportation, telecommunications and the internet, and the fight to end communicable diseases.

For without CBR’s nations will not be able to pay each other for purchases of basic things such as food and medicine and ordinary things like busses, trucks and motor cars.

Without CBR’s, the global financial and trading system would come to a halt, and affected countries will drop into poverty from which recovery will be costly both in time and money, but more importantly in human life.

And this grave threat has been hanging over the Caribbean now for almost half a decade; and it shows no sign of abating, despite statements to the contrary.

Right now, in many parts of the Caribbean, the majority of banks are reduced to having only one correspondent bank, and at an extremely high cost.

Not only have the fees for these CBR’s reached prohibitively high levels, they are taking longer periods of time to deliver services as a consequence of heightened scrutiny.

Where in the past a cross-border transaction could take 2 days, it can now take as long as two weeks from our smaller indigenous financial institutions.

The cost of doing business in our region is escalating, even as we try to cope with high debt, incurred largely to recover our countries from disasters that have increased in frequency and intensity, as a result of global warming and sea level rise that point like daggers at the heart of the existence of many of our island states.

It is claimed – wrongfully – that Caribbean countries have weak anti-money laundering and counter terrorism financing regimes, and this is the reason why global banks in the US are withdrawing CBRs.

But, I point out that the two bodies with the authority to judge the quality and standing of the regimes in the Caribbean have judged the majority of Caribbean countries to be in full compliance with their high standards.

Those bodies are the Financial Action Task Force and the OECD Global Forum in both of which the US is a decision-making member.

In some cases, Caribbean legislative and enforcement machineries have been rated at a higher level than in many developed countries.

Nonetheless, the Caribbean faces the real danger of being ‘de-banked’, and to be cut off from the world’s trading and financing system, including not being able to pay for its imports from its biggest supplier of goods and services – the United States of America.

I need hardly say that if Caribbean economies go into decline, the consequences will be increased unemployment, enlarged poverty, increased crime and the advent of economic refugees that will swell the numbers of those gathering on the US Southern border.

On a final note, we would be ducking an important issue if we did not note the expressed unhappiness in some quarters by the presence of the Peoples Republic of China as a partner in the economic development of the Caribbean.

Typically, Chinese government loans are for 20 years at 2 per cent interest, and because of them, Caribbean countries have been able build infrastructure, such as seaports, airports, low cost housing, roads and schools.

Without China’s investment over the last decade, the Caribbean region – as in Latin America – would have stagnated, if not reversed.

Caribbean countries have welcomed Chinese investment, including loans from the Government of China, not because they wish to displace traditional friends or to diminish their valued relations, but because China offers a lifeline for development in the absence of others.

Today, the majority of CARICOM countries are stable democracies where democracy and human rights are respected and upheld; where the rights of the individual and of businesses thrive; where the rule of law is maintained.

But these conditions are only sustainable in conditions of sustained development.

Democracy, freedom and the rule of law are fragile plants whose growth and strength must be watered and fed by the nutrients of economic development.

The United States of America cannot choose to move out of this neighborhood any more than can Caribbean countries opt to relocate elsewhere.

We each, therefore, have an obligation to recognize our mutuality of interests and act on it.

There is no better occasion to do so than this Caribbean American Legislative Week, and no better time than now.