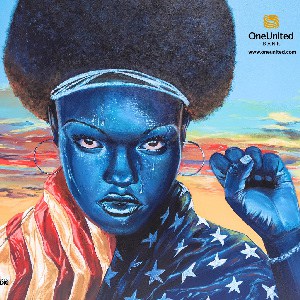

OneUnited Bank Launches #Bankblack Challenge

OneUnited Bank Launches The National #Bankblack Challenge To Demonstrate Black Economic Power

BOSTON– OneUnited Bank, the largest Black owned bank in America and the first Black internet bank, is launching the national #BankBlack Challenge, designed to harness the economic power of the Black community focused on one clear financial message that #BlackMoneyMatters.

The challenge: Participate in the #BankBlack Challenge by opening a OneUnited Bank $100 UNITY Savings account online from anywhere in America at www.oneunited.com/bankblackchallenge and challenging 20 friends to the same.

In recent weeks America’s Black community has galvanized via social media, Black media and word of mouth, answering the call for a show of economic force by moving their money from traditional banks to black owned banks, like OneUnited Bank.

The #BankBlack movement intensified on July 8th, 2016 when Rapper Killer Mike implored the Black community to deploy “a portion” of its financial resources to make a tangible difference during a town hall meeting on BET and MTV. Other celebrities such as Solange, Jessie Williams, Alicia Keys, Beyonce, Queen Latifah, and more have joined the conversation urging Black Americans to move their money to Black owned banks.

Since then, OneUnited has seen a sharp influx in web traffic and new accounts, with over $3 million deposited since this call to action.

“If 1 million people opened a $100 savings account in a Black owned bank, we would move $100 million! That’s real economic power”, states Teri Williams, President & COO of OneUnited Bank. “It is critical for the Black community to utilize our $1.2 trillion in annual spending power to create jobs and build wealth in our community.”

OneUnited is uniquely positioned to lead this Black financial empowerment movement to intelligently invest in the Black community and create generational wealth.

Banking with black owned banks results in better circulation of Black dollars, creates more jobs for the Black community, provides mortgage and small business loans for Black borrowers, educates the urban community on financial literacy, and harnesses the power of the black dollar.

For over two decades, OneUnited Bank, with locations in Los Angeles, Miami and Boston and its ability to open accounts online nationwide, has been steeped in the financial literacy movement.

Studies show black dollars leave the Black community after 6 hours as compared to 28 days in the Asian-American community.

OneUnited Bank is encouraging the Black community to move their money and extend the life of the black dollar.

To participate in the #BankBlack Challenge from anywhere in America go to www.oneunited.com/bankblackchallenge, open a $100 new savings account and challenge 20 friends to do the same.