Mortgage Indemnity Insurance Can Transform Jamaica’s Housing Market

KINGSTON, Jamaica – Patrick Thelwell, General Manager of the Jamaica Mortgage Bank (JMB), says an expansion in the level of coverage as well as the use of Mortgage Indemnity Insurance (MII) could substantially increase mortgage availability in Jamaica.

This is as he revealed that the MII Fund, administered by the JMB to provide MII protection, has a surplus of $ 1.103 billion. To date, the Fund has issued some 23,000 policies with a total sum insured of $638 million.

Mr. Thelwell said a new proposal to Cabinet has recommended that the insurable amount for the MII be increased from 90 percent to 97 per cent of the value of the property. He pointed out that increased use of this insurance would make home ownership more easily accessible to the public and could result in a significant expansion in mortgages .

“One of the main hindrances to home ownership is the large deposit required,” Mr. Thelwell stated. “If we can bring the deposit down…. we could get more people into homes.”

Mr. Thelwell was addressing a forum with representatives from financial institutions and the real estate sector, on Friday, November 9 at the Terra Nova Hotel in St. Andrew.

Mortgage Indemnity Insurance provides protection for mortgage lenders against loss where borrowers default on their loan. This allows lenders to take the risk of covering a higher percentage of the appraised value or selling price of the property, resulting in lower deposit requirements for borrowers.

“The risk of default, which is a major risk for most financial institutions, is wiped out,” he said. Through the use of MII, “you will have better pricing strategies because you don’t have to deal with the credit risks; it also allows you to better manage the bad debt portfolio.”

Earl Jarrett, Chairman of the Caribbean Association of Housing Finance Institutions, welcomed the new proposal to be implemented by the JMB and said the product will provide an opportunity for mortgage lenders to inject more capital into loans and will allow more Jamaicans to own a home.

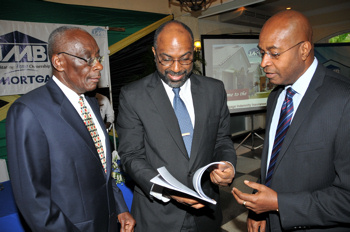

Patrick Thelwell (right), General Manager of the Jamaica Mortgage Bank goes through the Mortgage Insurance Act with Earl Jarrett (centre), Chairman of the Caribbean Association of Housing Finance Institutions (CASHFI) and Joseph Bailey (second left), Secretary General of CASHFI at the at the Mortgage Indemnity Insurance Dialogue at the Terra Nova Hotel in Kingston on Friday, November 9.

“Financial institutions need to be mindful of the risks on their balance sheet and must now look at the stress that they can take,” Mr. Jarrett said. “This programme provides an opportunity to strengthen their balance sheet.”

Mr. Thelwell affirmed that financial institutions making use of MII would be able to offer a wider choice of mortgage instruments, improved service and even lower mortgage rates. And, the JMB General Manager said that, “for the last 10 years, we have not been writing a lot of mortgages indemnity insurance because the mortgage lenders are not using the MII product as effectively as they ought to.”