MasterCard and RGX, Global Export Network, present “Good Practices in International Trade” in Jamaica

KINGSTON, Jamaica – With the goal of promoting best practices and improving the international business of small and midsize companies, MasterCard, in association with RGX (Global Export Network), has conducted a study with 200 small and midsize export companies from Jamaica, the Dominican Republic, Trinidad and Tobago and Puerto Rico on “Good Practices in International Trade”. The results of this study were presented today at a workshop for over 70 local businesses at JAMPRO.

Armando Alemany, vice president of new product sales for the GeoCentral division of MasterCard LAC, pointed out that the study’s main goal was to provide information about the best operating practices for international business and to explain methodologies for advancing successful international businesses. “At MasterCard we decided to support this study because we wanted to promote the development of foreign trade, an extremely important segment that constitutes a vital part of the national economy.”

The executive stressed that it is a priority for the company to support this segment, since it has the potential to make Jamaica more attractive as a destination for investment, helping to boost the country’s economic and social well-being, stabilizing prices, reducing the unemployment rate, and increasing its productivity and competitiveness.

Some of the main findings of the study show that:

• Email is the method preferred by the majority to conclude contracts, with the resultant legal risk that this entails. At the same time, one out of four companies fails to make its contracts subject to any national legislation in particular.

• FOB and CIF are the foreign trade terms—the “Incoterms”—that are most used, even in incorrect form, for operations via air and ground transport methods.

• 54% of all responses to the survey indicate that international transfers are the means of payment used the most by export and import companies.

One of the most important recommendations presented at the workshop was the fact that there is great benefit to small and midsize enterprises (SMEs) in the export business in making their international payments by credit card, rather than paying by means of international transfers.

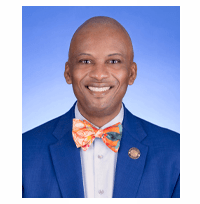

Dr. Ramon Scott, Consultant at RGX gave an engaging presentation on ‘Good Practices in International Trade – Studying Caribbean SME’S’ and ‘Good Practices in Local and International Marketing’ at the “Good Practices in International Trade” seminar held at JAMPRO.

Ramon Scott, spokesperson for RGX, made it clear: “Even though 54% of the companies interviewed use international transfers as their means of payment, credit card payment remains the fastest way to pay and to collect in international operations. Their security level for the trade relations is the same as that of a simple transfer, because it will be safe for both the exporter and the importer. In addition, importers can finance their payments for operations, enjoying a term of up to 30 days.”

JAMPRO’s Export Promotion Manager, Berletta Henlon Forrester noted that the manual prepared for the seminar constitutes a useful tool particularly for micro, small and medium-sized exporters. ‘The document breaks down in simple language critical issues of pricing, payment systems, transport and international insurance. This is especially important in the current world trade environment, which is now very much about ‘trade in tasks’, and not just finished goods. She added that seminars such as this one support the preparation of the export community for engagement and participation in the logistics hub initiative.

Marlene Porter, Export Development Manager at JAMPRO, makes an interesting point to Dr. Ramon Scott, Consultant at RGX, while Ray Merceron Vice-President & Territory Head – Western Caribbean, MasterCard (second left) and Armando Alemany, Vice-President & Head of Export Sales MasterCard- Colombia, Ecuador, Venezuela & the Caribbean (third left) look on during the “Good Practices in International Trade” seminar held at JAMPRO on Tuesday, July 16, 2013.

During the workshop, Alemany pointed out that MasterCard believes in the importance and need of a world beyond cash, and that electronic payments are a critical part of the solution so that SMEs can develop and save money, and their finances can expand. “We aim to anticipate and respond effectively to the needs of businesses around the world, as well as to develop payment solutions that work for them, wherever they may be and however they might conduct their business,” he emphasized. “Through our business partners, the banks, we offer a wide range of business payment solutions through MasterCard, customized to the diverse needs of small, medium, and large companies.”