Go-to Apps Winning the Money Transfer Scene in 2019

Banks took it quite long to make money transfer process convenient for people, sticking to the same old cash payment methods. But the people of fast pace world were looking for one-click-away solutions for their money transfer needs. Though online banking has been launched for some time, third party money transfer providers had already filled the gap. And even after the advent of online banking’s facility, third party money transfer apps are still winning the game!

Easy to use money transfer app has become a go-to solution when international payments are in question because the process is not only quick and easy but also secure.

So, if you are a business dealing internationally, or an expat who has transfer money to parents back at home, here are given some of the most anticipated money transfer apps to make the whole process a matter of push of a button.

Western Union:

It is hard to miss the name of Western Union whenever it is about transferring money around the world. So, there isn’t any surprise that it has a money transfer app, designed to make the money transfer process more convenient and handy for people and businesses. Western Union stays true to its tagline “moving money for better” by simplifying its process of rolling money.

You neither have to feel fed-up while entering lengthy details nor entering 16-digit verification code is a thing now. You can download the app for free, but you have to pay up to $5 for a transaction of $500. But it isn’t an issue when you can transfer money so easily and can also keep track of the whole process only be entering the tracking number (MTCN).

Venmo:

Venmo:

Venmo is a subsidiary company of PayPal and is facilitating individual users as well as businesses to transfer money across the globe. But it is going stronger among individual users due to its ‘digital wallet’ feature that enables peer-to-peer money transfer matter of few seconds. And isn’t it what today’s millennials want: easiest and quickest solutions to all their needs? And Venmo provides this to them! To add a bit of fun in the purchases, you can also add comments and emojis while sharing information about their transfer to contacts.

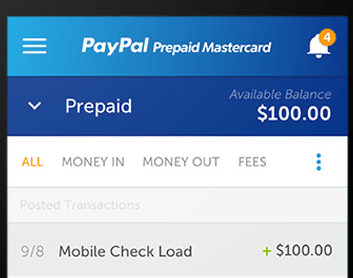

PayPal:

PayPal:

Offer the past few years, PayPal has gained immense popularity for money transfer services, significantly among businesses. Its app is equally popular due to its strong security features that ensure that you don’t have to undergo issue of identity theft. You have to enter the password every time you open the app, it might be annoying at times, but it is better to stay safe. But PayPal does charge you for its secure service, and its charges vary from country to country. Like, if you are sending to Canada or Europe, you have to pay $2.99, while for other countries it is $4.99.

So, now you know where to look if you want a hassle-free solution for your international money transfer needs.

Venmo:

Venmo: PayPal:

PayPal: