Senior Government Officials of the Americas Discuss Modernization of Financial System in Haiti

Miami – In an effort to help strengthen and modernize Haiti’s financial system, Citigroup and the Central Bank of Haiti hosted today in Miami the “Haiti Leadership Roundtable,” an event that brought together government officials, public sector leaders and industry experts from Haiti, the United States, and multilateral organizations to discuss the short and long term investments required to promote capital flows in the Caribbean country.

Panelists included the Minister of Finance and the Central Bank Governor of Haiti, representatives from Citi and the banks operating in Haiti, the Inter-American Development Bank, the International Monetary Fund, the United Nations, the U.S. Agency for International Development, the U.S. Federal Reserve, the U.S. Treasury Department and the World Bank, among others.

Opening remarks were given by the Minister of Finance of Haiti, Ronald Baudin, who stressed the Haitian government’s determination to create a favorable business climate and attract foreign direct investment in the country, particularly in infrastructure related projects. Charles Castel, Haiti’s Central Bank Governor, then discussed the state of Haiti’s banking infrastructure and the challenges facing the financial sector post earthquake.

“The Haitian banking system’s role is crucial for an economic recovery and growth. This Leadership Roundtable has been an important opportunity to pursue a constructive dialogue and work together toward achieving this major goal, through innovative solutions which enable to channel credit to viable firms to sustain growth,” said Mr. Castel.

“Citi is committed to leveraging its experience, knowledge and expertise to help Haiti develop and expand the existing capabilities of its banking system,” indicated James D. Wolfensohn, Chairman of Citi International Advisory Board and former World Bank President.

Francisco Aristeguieta, Citi Regional Head, Global Transaction Services Latin America, added: “The rebuilding efforts underway in Haiti, where we have presence since 1971, should serve as an opportunity to strengthen and modernize Haiti’s financial system. We are pleased that this Leadership Roundtable has convened global, regional and country financial leaders to develop short and long term actions to enhance the financial system in Haiti.”

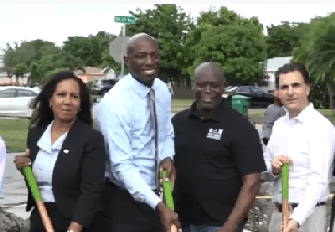

From left to right: Ronald Baudin, Haiti Minister of Economy and Finance, Jay Collins, Citi’s Global Head, Public Sector, Charles Castel, Governor of the Central Bank of Haiti, Valentino Gallo, Citi’s Global Head, Export Agencies Financing and James D Wolfensohn, Chairman & Senior Advisor to Citi.

Citi started operations in Latin America more than 100 years ago, and currently has a presence in 25 countries, making it the bank with the broadest geographic coverage and one of the largest regional players in terms of loans, deposits, revenues and net income.

The panelists also provided their insights on the short and long term investments required to promote the development of the financial system in Haiti. Key topics discussed included the challenges and opportunities facing the banking sector; the management of aid related financial inflows; ideas on how to increase availability of credit and improve credit risk, including supply chain finance; and leveraging emerging technologies to create the transparency, efficiency and control that will optimize treasury management for the public sector.