Jamaica National (JN) Prepares for Transformation in Anticipation of BOJ Response

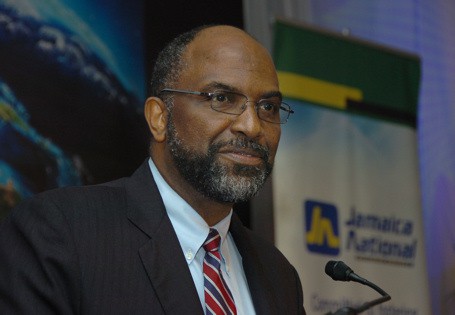

KINGSTON, Jamaica – Earl Jarrett, General Manager of the Jamaica National Building Society (JNBS), says the organisation is anticipating a response to its application for a commercial banking licence from the Bank of Jamaica (BOJ) soon.

Speaking to members of the Society at its 140th Annual General Meeting on Wednesday, July 23 at the Jamaica Pegasus Hotel, Mr Jarrett revealed that JNBS had resubmitted its application to the BOJ in November 2013. And, he revealed that the application details a concept to transform the JN Group structure to ensure its compliance with the new Banking Services Act (2014).

“Indications are that we should hear from them soon,” he confirmed, adding that the organisation has a highly competent transformation team and advisors in place to manage the transition process.

He said the Society’s resubmission for a banking licence was triggered by the demand from a majority of its members for commercial banking services. Under the Banking Services Act, only licenced financial institutions can offer commercial banking services, such as credit cards, chequing accounts and certain personal loan products.

“What our members were telling us is that by virtue of being a member of Jamaica National you were obligated to have an account with another bank because we didn’t offer a cheque book, we didn’t offer the credit cards, we didn’t offer various financial instruments,” he said.

“Therefore, our idea was to keep mutuality alive and have within a new structure, a modern bank that would deliver the services that you wanted.”

In that respect, he explained that members’ mutual rights will be preserved in the new JN Group structure, which has been proposed to the BOJ in keeping with the new Banking Services Act (2014). Mr. Jarrett noted that the new Act, in addition to stipulating new requirements for governance within deposit-taking institutions, requires banking organisations, which have other regulated financial entities within their group structure, to separate their financial entities from their non-financial entities.

“What the rules are saying is that we have to break this down and have a financial holding company and a non-financial holding company to separate financial activities from non-financial activities.”

He continued: “In order to do this the management and board have given great consideration to this process and last year we made the application to the BOJ explaining that we would establish a Jamaica National Mutual Holding Company in which mutuality would reside.”

He pointed out that the rights of members will be transferred to the JN Mutual Holding Company, through which members will maintain ownership of the entire Group’s assets, including the two sub-holding companies, which will own the Group’s financial and non-financial entities, respectively.

“Effectively what we would have is a structure that would enable us to meet the requirements of the law, but provide the framework so that we can have the separations required; retain mutuality in the holding company, in that it would be a company limited by guarantee without shares, and that is where your ownership rights would now reside,” he explained to members.

He underscored that the new framework will also provide the “architecture to face the world that we are facing today” and prepare the organisation to meet the requirements of the new Banking Services Act within the stipulated year given to become compliant.

Mr. Jarrett cautioned, however, that the transformation concept was yet to be approved by the BOJ.

“It’s not done. What I’ve shared with you is the concept. The next stage is upon approval by the Central Bank, we will have to have what is called a scheme of arrangement, where we’ll have to approach the court for such an arrangement. After that, we will need to have another meeting with you at which you vote yes or no for this transition; and, we will then go through and effect the transition,” he outlined.