IMF Advises St. Kitts Government To Come Up With A New Strategy

IMF wants Denzil Douglas’ macro-financial stability and hard-earned gains in debt sustainability preserved

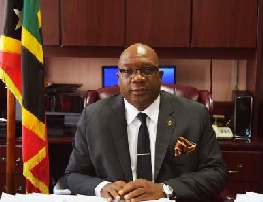

WASHINGTON, DC – The International Monetary Fund (IMF) is advising the Timothy Harris Team Unity Government to come up with a multi-pronged strategy to preserve the successes of the St. Kitts-Nevis Labour Government’s macro-financial stability and hard-earned gains in debt sustainability.

The Washington-based financial institution said that although the twin-island federation continued to enjoy strong macroeconomic performance in recent years under the stewardship of then Prime Minister and Minister of Finance, the Rt. Hon. Dr. Denzil L. Douglas, the outlook is highly dependent on developments in the Citizenship by Investment Programme (CIP).

The IMF said the St. Kitts and Nevis economy continued its strong growth at around five per cent, recording the strongest growth in the region over 2013-2015.

The St. Kitts-Nevis Labour Government left office in February 2015 and the new Harris Government operated on the St. Kitts-Nevis Labour Administration 2015 Budget passed in the National Assembly in December 2014.

The IMF said the strong growth has been underpinned by several Labour Government initiated construction projects and tourism sector activity and their favourable spill-over on the rest of the economy, supported by surging inflows from the Citizenship-by-Investment programme.

“Large CIP inflows continued in 2015, albeit at a slower pace, reflecting the temporary impact of the program reform and increased competition from similar programs in the region.”

The IMF said that the elements of the new strategy should include strengthening the fiscal framework to reduce reliance on CIP inflows, while preserving the accumulated savings from the CIP programme and further improving public financial management.

It said the strategy also calls for resolving the debt-land swap to safeguard financial stability, while mitigating emerging financial sector risks; and enhancing competitiveness, diversification, and resilience to shocks, including from natural disasters.

“A prudent medium-term fiscal framework with a zero primary balance target, net of CIP receipts and Sugar Industry Diversification Foundation (SIDF) grants, would help safeguard fiscal sustainability, with the adjustment paced over the medium-term.”

The IMF said that the framework would help build resilience to negative surprises in future CIP inflows, and facilitate accumulation of fiscal buffers to address external shocks and absorb unforeseen financing needs if tax performance disappoints after CIP flows decline.

“Implementing this framework requires broadening the tax base, including by streamlining tax incentives and further improving compliance, especially at the Nevis Island Administration (NIA) level, as well as containing recurrent spending.” It said that the authorities’ commitment to a comprehensive review of the concessions regime is welcome, as well as plans to contain the wage bill and spending on goods and services.

The IMF said that establishing a ‘Growth and Resilience Fund’ can help preserve the accumulated savings from the CIP programme, while providing a contingency buffer for future shocks, such as costly natural disasters.IMF wants new strategy to preserve financial stability in St. Kitts-Nevis.