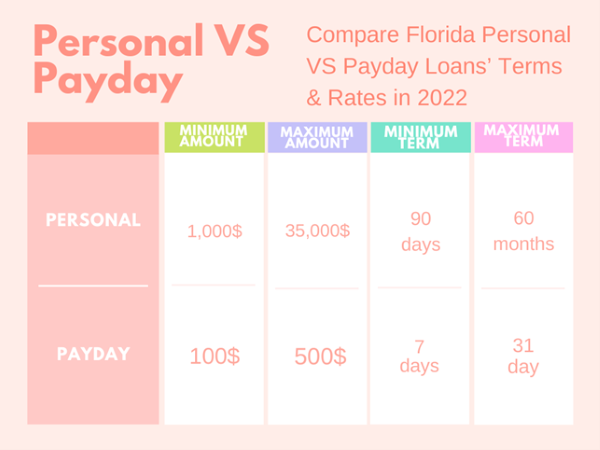

Compare Florida Personal vs Payday Loans’ Terms & Rates in 2022

Do you urgently need extra cash, but you know that you will not be able to apply for a bank loan? Thinking about clients like you, non-bank companies in Florida have enriched their offers with payday and personal loans. If you are looking for a proven long-term or payday loan, be sure to read the information contained in this article.

What kind of loans in Florida are we most often looking for?

- A non-bank loan – this is a loan that we will get in an institution that is not a bank and you will find them on the websites of lenders.

- A payday loan is a type of quick loan usually granted for a short period and not a large sum. Of course, you will find such short-term Payday Loans in Florida on pitriloans.com.

- A personal loan is also a type of quick loan, but due to the repayment in installments, the funds are made available for a longer period and usually a higher amount than for payday loans.

- Loans for indebted people – people with bad credit have nothing to look for in a bank, but loan companies do not reject such customers, because they often set much less restrictive conditions than banks and offer loans to the indebted, and thus can save in a difficult situation financial. These are loans without credit check.

How to find the best payday loan in Florida?

On the Internet you will find 0% APR loans, post office loans, home service loans, loans from 18 years, from 23 years and more. How to find yourself in all this and how to find the best payday loan in Florida? First of all, you need to define what you are looking for. Is the priority for the first free loan, the repayment period or maybe the maximum loan amount? Or maybe the borrower’s age is key? The ranking of payday loans is not only basic loan data, but also additional information:

- information about promotions – this is the most frequently searched criterion, everyone wants to take advantage of the offer in the promotion and find a loan as cheap as possible or even without fees – it is fully understandable;

- loan holidays – by borrowing money you are not able to predict the future – so it is worth knowing whether the payday loan gives the possibility of extending the repayment date – installment vacation, loan holidays;

- database verification – you want to borrow money but you have wrong database entries? The ranking of payday loans is a place where you will find loans without credit check.

What personal loan will be the best for me?

First, decide what loan amount you need. A personal loan should be a thoughtful decision, because taking it out is most often associated with costs. Before choosing an offer and signing the contract, think about how much funds you really need and for what purpose you want to allocate them. At this stage, also consider whether you really need to get into debt. Perhaps you do not need the expense you want to incur.

Once you have a fixed amount, choose the length of time you want financing. In the case of a long-term personal loan, you can return the money in weekly or monthly installments. Depending on the lender, the repayment can be spread over a minimum of 3 months, and the maximum repayment period is 60 months. 12-month loans are a frequently chosen option. However, you must remember that the longer the repayment period is, the higher the costs will be. You can get quick Personal Loans in Florida on pitriloans.com.

Knowing how much and for what period you want to borrow, compare the offers of loans and make a choice. Then prepare your ID card and start applying for an online loan. Before submitting the application, check the cost of the personal loan carefully. The availability and ease of taking out personal loans has a price. It is difficult to find free loans in this type of products, so while browsing the offers, check the total cost of the liability and the APR (the annual percentage rate). Remember that the fees can be much higher if you do not pay back the liability according to the specified repayment schedule.

Required formalities

Most loan companies put the following on their list of requirements both for payday and personal loans:

- ID card – This document confirms the data provided by the person applying for the loan. It is not necessary to present it in person, but in the application it is most often necessary to state the number and series of ID.

- Appropriate age – Each company has different age requirements for its customers. In most cases, the loans are addressed to recipients in the age range from 18 to 75 years.

- American citizenship – Most financial institutions grant loans only to citizens of the USA who have a residence address in Florida. Foreigners and people who permanently live outside the US have little chance of getting a loan online.

- Bank account operating in the US – The client’s bank account is necessary to verify his identity and transfer the loan to a card from which money will then be debited.

- American mobile phone number – This is another condition without which it may be impossible to obtain a loan online. The number provided in the application must be active. It will be used to check the correctness of the information provided and inform the lender about the decision of the lender.

- E-mail address – The e-mail address is to facilitate the company’s contact with the borrower. For example, a loan contract is sent electronically.

With personal loans, additional documents are also sometimes necessary. Although the ID card itself is enough to complete the application, some companies also require their clients to present:

- employment contract or other confirmation of the source of permanent income;

- bank account statement for the last few months;

- certificates of the amount and validity of benefits such as retirement pension; disability pension or the right to receive other benefits.

If you have problems with income proof and you are the owner of a car, you can contact Top car Title Loans Lenders in Florida. In order to receive such a loan, you need to transfer 51% of the vehicle ownership to the lender till the moment when the loan repayment is completed. However, the car will still remain at your disposal.

The process of granting a loan in Florida

If you decide to take advantage of an online non-bank loan, you only need a few simple steps.

- Determining the loan amount and repayment date – after a thorough analysis of your financial situation, you should determine the amount and time of repayment. Remember to borrow only as much money as you can repay. Choose the amount according to your financial capabilities.

- Choosing the best offer – see the total cost of the commitment and the opinions about a specific company.

- Filling out the loan application – the next step is to fill in the online form – provide only true information about personal data and the amount and source of income.

- Issuing a decision on granting or a loan – if the data is correct, you will be informed whether you have been granted a loan.

- Receiving a loan on your account – thanks to express transfers, money can reach the indicated account within minutes after receiving a positive decision.

How much does the loan in Florida cost?

It is worth remembering that personal and payday loans offered by loan companies are sometimes much more expensive than loans granted by banks. This is due to the high investment risk and the financing of loans with companies’ own funds. The exception is a free payday loan, which can be used by new customers.

The costs of the liability are mainly due to:

- the amount of the loan granted;

- the period of its repayment;

- interest rate;

- annual percentage rate.

When choosing a specific loan offer, it is also worth checking if additional fees are waiting for us.

They can be:

- preparation fee;

- administrative fee;

- commission;

It does not hurt to read the costs associated with delays in paying (including reminders).

When comparing online loan offers, you should pay special attention to the APR, i.e. the annual percentage rate. It is a valuable indicator that allows you to easily estimate the profitability of the liability. The APR includes all basic costs that the borrower will incur after the conclusion of the contract.