Central America/Caribbean Can Reduce their Oil Dependency, Says WB Report

WASHINGTON, DC- Central American and Caribbean countries can reduce their oil dependency and shield themselves from high oil prices through a combination of renewable energy, energy efficiency programs and regional energy integration, says a new World Bank report.

According to “Mitigating Vulnerability to High and Volatile Oil Prices: Power Sector Experience in Latin America and the Caribbean,” launched today ahead of the II Latin American and Caribbean Oil and Gas Seminar in Montevideo, Uruguay, the region overall is a net exporter of crude oil and oil products; yet all countries in Central America and the Caribbean are net importers of these products. In both sub-regions, oil provides more than 90 percent of primary energy needs—more than one-third higher than the average for the Latin America and Caribbean region and more than twice the global average.

“We estimate that the implementation of a strategy that combines a more diversified power system, better energy efficiency in electricity production and use, and regional integration can significantly reduce Central America and the Caribbean’s vulnerability to high and volatile oil prices,” said Ede Ijjasz-Vasquez, World Bank Director for Sustainable Development in the Latin America and Caribbean region. “Because of their exposure to oil price fluctuations, less oil dependency can have a positive effect on these countries’ fiscal balance and ultimately benefit the poorest sectors of the population.”

For countries in Central America and the Caribbean, the average improvement in the current account balance would amount to approximately 1.6 percent of gross domestic product (GDP). At the country level, Guyana and Nicaragua could witness reductions in their current account deficits of up to 5 percent of GDP, while Haiti and Honduras could see reductions of about 3 percent of GDP.

The report notes that the past decade has witnessed an unprecedented rise in world oil prices and oil price volatility adversely affecting oil importing and exporting nations alike. Since 2002, the spot price for West Texas Intermediate (WTI), a grade of crude oil used as a benchmark in oil pricing, has increased more than fivefold.

Economies are directly and indirectly affected by high and volatile oil prices. The major direct effects are a deteriorating trade balance, through a higher import bill; and a weakening fiscal balance, due to greater government transfers and subsidies to insulate movements in international energy markets. Indirectly, high and volatile oil prices also have a major impact on inflation rates. They reduce consumer confidence and purchasing power, while raising uncertainty among investors, and reducing competitiveness due to higher power generation and transport costs.

The report argues for structural measures designed to reduce oil consumption, including (i) using renewable energy sources, (ii) investing in energy efficiency, both in the demand and supply side, and (iii) increasing regional integration with countries endowed with more diversified supply.

Using Renewable Energy Sources

Renewable energy directly reduces the need for oil as a source of power generation. Such substitution also reduces greenhouse gas (GHG) emissions. The Latin America and Caribbean region has a wide array of renewable resources and technologies available, including wind in Argentina, hydroelectricity and biomass in Brazil, and geothermal in Central America. In 2007, renewable energy represented about 59 percent of the region’s total power generation -higher than any other world region.

For both Central America and the Caribbean, a 10 percent increase in renewable potential capacity could lead to savings of 14.2 million and 5.6 million barrels of diesel and heavy fuel oil, respectively, representing an average reduction of almost 1 percent of GDP.

Improving Energy Efficiency

Investing in energy efficiency of both production and end use is one of the most cost-effective ways to reduce the need for oil and oil-derived products. Reducing peak and non-peak use helps to reduce the generation capacity required to supply the system.

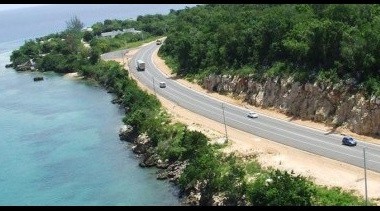

Among countries in Central America and the Caribbean, Nicaragua and Jamaica would achieve the largest fuel savings by taking advantage of energy-efficiency strategies. For Honduras, supply-and demand-side efficiency gains would lead to savings of up to 1 percent of GDP, and nearly 1.5 percent of GDP for Nicaragua and Jamaica.

Promoting Regional Integration

Due to economies of scale, regional energy integration can help countries to reduce their oil dependency by diversifying generation sources (more renewable energy and natural gas), improving efficiency, lowering generation costs, and reducing GHG emissions.

The two main mechanisms mentioned in the report are constructing electricity inter-connections and building natural-gas infrastructure. As an integrated power market, Central America leads in experience and level of progress. Its advanced integration plans to trade electricity with Mexico in the north and Colombia in the south offer a clear path to reducing the region’s vulnerability to higher and more volatile oil prices.

For Central America, the estimated annual savings from regional integration in electricity are 2.4 million barrels of diesel fuel and 1.8 million barrels of heavy fuel oil. These figures suggest a reduction of approximately 8 percent in the oil-fired share of these countries’ energy matrix.

In the Caribbean, the geothermal potential of some island nations can serve as the basis for a more diversified power market. The Dominican Republic and Haiti, in particular, can benefit from stronger integration on both the power and natural gas fronts.

In the short-term, the report also suggests using price risk management instruments to manage the uncertainty associated with commodity-price instability, particularly its impact on national budgets. A critical first step for any country considering an oil hedging strategy is careful risk assessment, taking into consideration commercial relationships in the power sector and interactions with public sector actors.

Price risk management solutions can include improving purchase agreements to make better use of flexibility related to pricing formulas (such as long-term fixed pricing or pricing based on monthly averages), and financial instruments such as option contracts, which can be used to create a price ceiling or price floor.

Support for the report was provided by the Energy Sector Management Assistance Program (ESMAP), a global knowledge and technical assistance program administered by the World Bank.