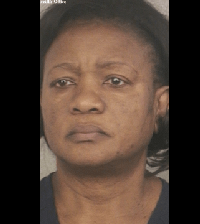

Prominent Jamaican Accountant in South Florida charged with fraudulently filing Income Tax Returns

SOUTH FLORIDA – Pamella B. Watson, 60, a prominent Jamaican Accountant of Davie, was charged with criminal complaint for submitting false, factitious, or fraudulent claims punishable by up to ten years in prison; aggravated identity theft punishable by a mandatory consecutive term of two years in prison; mail fraud punishable by up to twenty years in prison; wire fraud punishable by up to twenty years in prison; money laundering concealment punishable by up to twenty years in prison; and money laundering punishable by up to ten years in prison.

According to the complaint, Watson operated Watson & Associates Business Services, Inc., a tax preparation business in Miami. Watson allegedly used various methods to fraudulently file federal income tax returns and receive unauthorized tax refunds on behalf of her clients. She allegedly prepared the tax returns and provided the respective client with a copy of the filing which showed a refund amount and/or an amount payable to the IRS.

The complaint alleges that without the client’s knowledge or authorization, the figures on the prepared return were changed and a tax return showing a higher refund amount was in fact filed with the IRS. It is further alleged that the client’s bank account received the refund amount reflected on the copy of the filing shown by Watson and the remainder of the inflated tax refund was deposited into an account controlled by the defendant. The complaint alleges that the client did not have any knowledge of the refund falsification and splitting.

The complaint further alleges that Watson prepared approximately 557 federal income tax returns for her clients, for tax years 2010 through 2013. Allegedly, 395 (71%) of the filings received refunds which were split into an account controlled by Watson or the entirety of the refund was diverted into the defendant’s bank account. It is further alleged that 5 of the 557 tax return filings showed an amount due to the IRS and 11 of the tax return filings did not claim a refund. Allegedly, the remaining 541 (97%) tax returns claimed a refund.

The complaint further alleges that an IRS analysis of Watson’s bank accounts, for the period from approximately January 2011 through September 2014, showed more than $3,405,479.20 in tax refund deposits related to 183 client taxpayers. Allegedly, the analysis further showed that 10 checks (totaling $222,676) that had been written by the defendant’s clients to the IRS were in fact posted as credits to Watson’s personal tax account history.

Watson was ordered held in custody following her initial appearance on the complaint. A pre-trial detention hearing before United States Magistrate Judge Lurana S. Snow is scheduled for May 22, 2015 in Fort Lauderdale.